Volunteering to pay taxes is just one more government con that funds the institutional genocide of the American people

By Shoshoni,

Updated, June 7th 2021

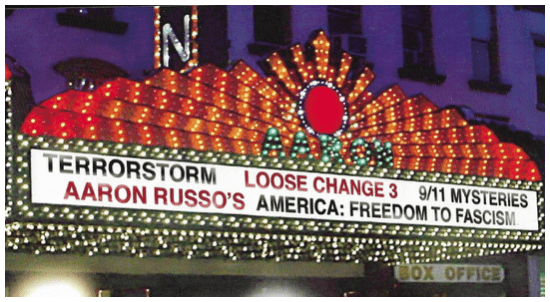

See and read below the truth about taxes and plans for the “Mark of the Beast” vaccine microchips and the great reset in the seminal movie AMERICA FROM FREEDOM TO FASCISM by late patriot Aaron Russo.

When passing new laws that affect all of the several states, or what is now understood as all fifty States, the Federal Government does everything according to the principles of “the common law”. The United States does not have a common law. Since all fifty states are supposed to be “sovereign”, all of their laws are made up of statutes. The principals of common law of the federal Government are delivered from the British Commonwealth, which derives its laws from its “Draconian overlords” who originally developed contract law, corporations and the uniform commercial code.

Therefore, in order for the Federal Government to tax a citizen, of one of the several states, they had to create some sort of contractual nexus. In order for there to be a contract, the parties to that contract should be known to each other. In order for any contract to be enforceable one party should know “who” they are handing over their sovereign rights to for something in return. All of the principals to the contract have to be known to each other, which is one of the required material facts of any valid agreement.

Thus, the Corporation of the UNITED STATES without disclosing their status as an agent of their anonymous principal IE [the Queen of England], created a legal fiction in so much as there is no such thing as an involuntary contract.

Even the Uniform Commercial Code [UCC] requires both parties to be aware that there is a contract and being fully apprised of the legal detriment involved agree to be bound by its covenants. What resulted is an involuntary blanket contractual system creating what is derived from that legal fiction, which is known as chattel paper.

This contractual nexus and the paper upon which a living breathing human has been allegedly bound is the social security card with its corresponding “Social Security Number”.

In 1935, the federal government instituted the Social Security Act. Before that time the Federal Government had no jurisdiction without the consent of the State in which it wished to exercise its authority. Only Federal lands like Indian reservations and military bases could be controlled without the consent of the State.

The Social Security Board then created “10 Social Security Districts”. The combination of these “Districts” resulted in a “Federal area” which covered all the states like a blanket of oppression emblazoned with the shapes and colors of the Union Jack.

Furthermore, this law created the ten kingdoms with ten Governors who have always been Kings without crowns. Are these the same 10 districts with their corresponding governors that were appointed by Obama at the behest of his puppet master’s of the New World Order and their leader the Queen of England?

In 1939, the federal government instituted the “Public Salary Tax Act of “. This Act is a municipal law of the District of Columbia for taxing all federal and state government employees and those who live and work in any Federal areas.

The government knew it couldn’t tax state Citizens who lived and worked outside the territorial jurisdiction of Article 1, Section 8, Clause 17 (1:8:17) or Article 4, Section 3, Clause 2 (4:3:2) of the U.S. Constitution.

Therefore in 1940, Congress passed the “Buck Act“, 4 U.S.C.S. Sections 105-113. Section 110(e), of this Act authorized any department of the federal government to create a “Federal area” for imposition of the “Public Salary Tax Act of 1939”.

This tax was imposed under 4 U.S.C.S. Sec. 111. The rest of the law is found in the Internal Revenue Code and the Social Security Board had already created a “Federal area” overlay. 4 U.S.C.S. Sec. 110(d). The term “State” included any Territory or possession of the United States.

4 U.S.C.S. Sec. 110(e). “The term “Federal area” means any lands or premises held or acquired by or for the use of the United States or any department, establishment, or agency of the United States; and any Federal area, or any part thereof, which is located within the exterior boundaries of any State. These areas shall be deemed to be Federal areas located within the State.”

The real result is the imposition by the federal “State” of an excise tax under the provisions of 4 U.S.C.S. Section 105, which states in pertinent part:

Sec. 105. “State, and so forth, taxation affecting Federal areas; sales or use tax (a) “No person shall be relieved from liability for payment of, collection of, or accounting for any sales or use tax levied by any State, or by any duly constituted taxing authority therein, having jurisdiction to levy such tax, on the ground that the sale or use, with respect to which such tax is levied, occurred in whole or in part within a Federal area; and such State or taxing authority shall have full jurisdiction and power to levy and collect any such tax in any Federal area within such State to the same extent and with the same effect as though such area was not a Federal area.”

No matter what the tax is called, if its purpose is to produce revenue, it is an income tax or a receipts tax under the Buck Act [4 U.S.C.A. Secs. 105-110]. Humble Oil & Refining Co. v. Calvert, 464 SW 2d. 170 (1971), affd (Tex) 478 SW 2d. 926, cert. den. 409 U.S. 967, 34 L.Ed. 2d. 234, 93 S.Ct. 293.

Thus, the term Federal Area became any part or parcel for which the Federal government either tricked an individual into involuntary servitude or used the bogus imposition of Federal largesse, which is actually created by income paid to each State by its citizens.

Then the States pay it to the Federal Government, so that they can use it to control the State and each state’s citizen’s body and soul.

This scheme destroyed the basis of the Republic, which was founded upon the guiding principle of separation with each State being sovereign. It also removed the sovereignty of every American citizen born on American soil and whose parents were also American citizens. Furthermore, it bound them as American taxpayers into slavery, as chattel on the Queen’s plantation Corporation of the UNITED STATES in perpetuity.

In fact, a child born a sovereign, with its rights derived from its creator, within the Sovereign and territorial boundaries of one of the several states, involuntarily gave up all of its rights through the registration of its birth certificate by its unwitting parents.

That certificate of birth had been the first deposit into the trust fund from which he or she would rarely receive the benefits, while a Trojan horse turncoat government sold them on the New York stock exchange for the use and primary benefit of the City of London and the British Monarchy.

A “Federal area” is any area designated by any agency, department, or establishment of the federal government. This includes the Social Security areas designated by the Social Security Administration, any public housing area that has federal funding, a home that has a federal bank loan, a road that has federal funding, and almost everything that the federal government touches through any type of aid”. Springfield v. Kenny, 104 N.E. 2d 65 (1951 App.).

The “Federal area” attaches to anyone who has a Social Security Number or personal contract with the federal or state governments. Therefore, anything that one must pay the government for, including licenses, fees, mortgage insurance, disability benefits through workmen’s comp, marriage licenses, car registrations, a parking ticket or even the use of a zip code attached to a mail box, binds one with chattel paper.

This chattel paper is part and parcel of the bogus contract that binds us to an enslaver that Americans fought a revolutionary war to disengage from and its oppressive taxation and control of the currency which early American were being subjected to when they decided to revolt against King George!

Furthermore, what American taxpayers believe is actual representation, is nothing but a legal fiction and a perpetual distraction by a clown show for the entertainment of the masses, unless one actually takes it seriously. Anyone with even an ounce of intellect can see that the laws, which have already been passed by our so-called representatives in Congress and in the Courts, have only helped to service our unseen overlords at our continual expense.

Through this mechanism of taxation, the federal government usurped the Sovereignty of the People, as well as the Sovereignty of the several states, by creating “Federal areas” within the boundaries of the states under the authority of Article 4, Section 3, Clause 2 (4:3:2) in their amendments to the Constitution, which states:

2. “The Congress shall have Power to dispose of and make all needful Rules and Regulations respecting the Territory or other Property belonging to the United States, and nothing in this Constitution shall be so construed as to prejudice any claims of the United States, or of any particular State.”

Thus, Congress has hidden the fact that they have guided through their leadership or lack thereof those who are their constituents being U.S. citizens [i.e. citizens of the District of Columbia] residing in one of the states of the Union to the status of chattel and into abject enslavement.

There is no basis in fact to this law unless one actually is a resident of the District of Columbia. Those residents have always been domiciled at suffrage and without representation in their own city! District of Columbia residents are not allowed to vote but they are required to pay taxes.

This status has classified the American people through U.S. citizenship as property, and franchisees of the federal government, and as “individual entities”. See Wheeling Steel Corp. v. Fox, 298 U.S. 193, 80 L.Ed. 1143, 56 S.Ct. 773., Under the “Buck Act”, 4 U.S.C.S. Secs. 105-113, “the federal government has created a “Federal area” within the boundaries of all of the several states.”

This area is similar to any territory that the federal government acquires through purchase, conquest or treaty, thereby imposing federal territorial law upon all people in this “Federal area”.

One can deduce Federal territorial law is in effect or what some call admiralty law controlled by the uniform commercial code brought to hold over the UNITED STATES by Britain from the Executive Branch’s gold-fringed U.S. flag.

One can see this flag flying in schools, Post Offices and all State and Federal courtrooms which are connected to the American Bar association headquartered and controlled by the Temple Bar, situated in the City of London, London England.

Therefore, when an attorney joins the American bar association, he is disallowed from representing clients who want to legally question the income tax laws or use settled Supreme Court case law before a certain date because “Stare Decisis” would render current income tax law the fraud that it is!

The original thirteenth amendment which was buried until Congress decided to revive it to use against President Trump, disallows any public office holder from receiving a title or emollient from any foreign country, leader or monarch.

Therefore, any public office holder who receives a knighthood like Bush Senior received or any attorney who has sworn an oath to the Queen of England in order to join the American “BAR” association, is prohibited by the 13th amendment from holding public office in the Federal government of the United States or any of the fifty sovereign states.

If you live on land in one of the states of the Union that is not in any “Federal State” or “Federal area”, and you are not a federal employee or involved in any activity that would make you subject to “federal laws” including having a mailbox or address to which mail is delivered, you are exempt from income tax.

However that means that you cannot have a valid Social Security Number, because if you are an American citizen who ever had one you cannot have a “resident” driver’s license, a motor vehicle registered in your name, a “federal” bank account, a Federal Register Account Number relating to Individual persons [SSN], (see Executive Order Number 9397, November 1943), or any other known “contract implied in fact” that would place you within any “Federal area” and thus within the territorial jurisdiction of the municipal laws of Congress.

Since all acts of Congress are territorial in nature they will only apply within the territorial jurisdiction of Congress. (See American Banana Co. v. United Fruit Co., 213 U.S. 347, 356-357 (1909); U.S. v. Spelar, 338 U.S. 217, 222, 94 L.Ed. 3, 70 S.Ct. 10 (1949); New York Central R.R. Co. v. Chisholm, 268 U.S. 29, 31-32, 69 L.Ed. 828, 45 S.Ct. 402 (1925).)

The way Congress entrapped most American citizens into paying income tax was to create a fictional Federal “State within a State“. See “Howard v. Sinking Fund of Louisville,” 344 U.S. 624, 73 S.Ct. 465, 476, 97 L.Ed. 617 (1953); “Schwartz v. O’Hara “TP. School Dist., 100 A. 2d. 621, 625, 375 Pa. 440. (Compare also 31 C.F.R. Parts 51.2 and 52.2, both cases identify a fictional State within a state.)

This fictional “State” is identified by the use of two-letter abbreviations like “CA”, “AZ” and “TX”, as distinguished from the authorized abbreviations like “Calif.”, “Ariz.” and “Tex.”, etc. This fictional State also uses ZIP codes which are applicable within the municipal and exclusive legislative jurisdiction of Congress.

The “Buck Act”, 4 U.S.C.S. Secs. 105-113, accomplished the entire scheme and was used to implement the application of the “Public Salary Tax Act of 1939″ for workers within the private sector.

This made all private sector workers with Social Security numbers subject to all state and federal laws “within a particular State“. This is a “fictional Federal area”, overlaying the land in the state of California and in all other states in the Union. In California, this was established by “California Form 590, Revenue and Taxation”.

You may renounce your Social Security number and its requirement that you pay social security tax and depend upon your own resources for your retirement. The argument for this renunciation is that there was no basis for a contract in the first place by the fact of “infancy” as you being one of the principals to that contract. A contract made by anyone under 18 years of age, is null and void on its face

The infant was you who were unscrupulously yoked shortly after birth thus before the age of majority to this slave system that continues to be dishonestly called an entitlement which you have been paying into all of your working life.

If you are in fact domiciled in the Sate of California on non-Federal Land you can state that you live in California. This establishes that you do not live in a “Federal area” and that you are exempt from the “Public Salary Tax Act of 1939” and also from the California Income Tax for residents who live “in the State”.

The following definition is used throughout the several states in application of Congress’s municipal laws which require some sort of contract for proper application. This definition is also included in all the codes of California, Nevada, Arizona, Utah and New York:

“In this State” or “in the State” means within the exterior limits of the State … and includes all territories within such limits owned or ceded to the United States of America.”

This definition also concurs with the “Buck Act” supra which states:

110(d) the term “State” includes any Territory or possession of the United States”.

110(e) The term “Federal area” means any lands or premises held or acquired by or for the use of the United States or any department, establishment, or agency of the United States; and any Federal area, or any part thereof, which is located within the exterior boundaries of any State, shall be deemed to be a Federal area located within such State”.

What has been hidden from those who pay the taxes is who and what is represented by the term “United States” which should be written “The Corporation of the UNITED STATES” “a subsidiary of “The British Virginia Company and the City of London”.

That’s why most social security checks are directly deposited in to a recipient’s bank account. Otherwise, the Commonwealth or the United Nations account from where it is drawn might be questioned by the recipient.

The jurisdictional nexus that places one within the purview of the federal government thus within the noose of its manipulated taxation can be avoided, by those few, who have the resources to do so and want to remain American citizens. However, they must be diligent, to remain free of this Trojan horse bearing the banner of tyrannical control, by the world’s leading authoritarian, in the form of the Union Jack.

Today, there are few Americans left, who remember why “The Declaration of Independence” was written in the first place. Those few are the nation’s patriots who have always hated the fact that freedom’s “old nemesis” remains within our nation’s entrails.

Don’t expect Congress however, to take down or even really question this greedy usurper, in the form of the private Federal Reserve Banking system, which they have helped to create and that they maintain through the use of “waiver or failure to remove our consent to it, under contract law.”

That means that when an American citizen takes this tyranny to task, he is being told that as a citizen, he has been “voluntarily” paying his income taxes.

“By law, there is no such thing as an involuntary contract!”

“However, in reality all awake American taxpayers know that they are being coerced by force, into paying for that which they do not owe and for which their payment is increasingly being used toward their ultimate demise.”

The idea that “income taxes or voluntary” has been, disproven time and again by Americans who question them, fail to pay them or use the legal system and the correct laws to successfully deny them. Most have been incarcerated or murdered for their knowledge and use of that knowledge to challenge the unconstitutional nature of the IRS, its origins, its domicile in Puerto Rico, and its jurisdictional boundaries.

Today there is only one class of individuals who can get away with not paying taxes because paying taxes is directly connected to having a social security number. Getting a social security number, requires either having an American birth certificate as proof of one’s birth on American soil or naturalization papers as proof that one went through the legal process, to become a legal citizen of this country.

These individuals, who do not have to pay taxes, do not have American birth certificates or naturalization papers. They do not have American citizenship. Therefore, they do not have authentic social security numbers. However, they have been given all of the benefits, and protections of the laws of the state in which they are located!

For instance, in the State of California, those who have crossed over the southern border into the State of California illegally, have been given driver’s licenses, welfare, free legal counsel and medical care, food stamps, help with rent, and access to voting in California’s elections.

They are even being put in positions of political power by treasonous politicians, who are involving themselves in the corruption and undermining of California and the United States, in favor of their country of origin. They are doing so by both political and fiscal means. Moreover, these non-citizens are being counted as citizens of the State of California for the purpose of the State being given more seats in Congress than they deserve.

These seats are based upon population statistics that are being created by fraud and paid for by the taxpaying legal citizens of the State of California. That is why the status of Sanctuary State, which has been imposed upon the citizens of California, is an act of treason against the people of California and against the Constitution of the United States of America! Furthermore, Sanctuary State status that has been implemented ‘without our consent’ and without even asking California’s citizens if we agree to it, is a breach of our social contract, by those who are supposed to represent us!

This is being covered up by our illegitimate, corrupt Globalist, politicians, and by the fake news of the Main Stream Media. They are using accusations of racism against every legal California citizen who questions their methods regardless of that legal citizen’s race. Moreover, they are using terrorist tactics to stop us from using our right to vote against Sanctuary State status in our California elections.

“The traitors in Silicon Valley and Hollywood are using censorship and lies to shut us up. Therefore, there has never been a more potent reason for a tax revolution, by legal taxpaying citizens than in those States that insist on being a sanctuary to those who do not have to pay taxes!”