IS THE U.S. BANKING SYSTEM SAFE? – 15 YEARS LATER

Submitted by The Burning Platform

“We’ve got strong financial institutions…Our markets are the envy of the world. They’re resilient, they’re…innovative, they’re flexible. I think we move very quickly to address situations in this country, and, as I said, our financial institutions are strong.” – Henry Paulson – 3/16/08

“I have full confidence in banking regulators to take appropriate actions in response and noted that the banking system remains resilient and regulators have effective tools to address this type of event. Let me be clear that during the financial crisis, there were investors and owners of systemic large banks that were bailed out . . . and the reforms that have been put in place means we are not going to do that again.” – Janet Yellen – 3/12/23

With the recent implosion of Silicon Valley Bank and Signature Bank, the largest bank failures since 2008, I had an overwhelming feeling of deja vu. I wrote the article Is the U.S. Banking System Safe on August 3, 2008 for the Seeking Alpha website, one month before the collapse of the global financial system. It was this article, among others, that caught the attention of documentary filmmaker Steve Bannon and convinced him he needed my perspective on the financial crisis for his film Generation Zero. Of course he was pretty unknown in 2009 (not so much anymore) , and I continue to be unknown in 2023.

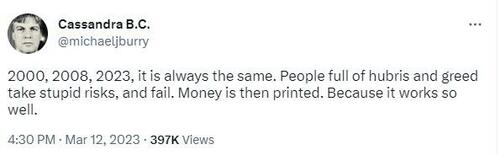

The quotes above by the lying deceitful Wall Street controlled Treasury Secretaries are exactly 15 years apart, but are exactly the same. Their sole job is to keep the confidence game going and to protect their real constituents – the Wall Street bankers. And just as they did fifteen years ago, the powers that be once again used taxpayer funds to bailout reckless bankers. Two hours before the only solution the Feds know – print money and shovel it to the bankers – Michael Burry explained exactly what was about to happen.

When Biden, Yellen, and the rest of the Wall Street protection team tell you the banking system is safe and they have it under control, they are lying, just as I said fifteen years ago.

“Our economy and banking system is so complex and intertwined that no one knows where the next shoe will drop. Politicians and government bureaucrats are lying to the public when they say that everything is alright. They do not know. Should you believe a governmental agency that wants the public to remain in the dark to avoid bank runs, or an independent analysis based upon balance sheet analysis?”

Back in the days of The Big Short, before the public knew about toxic subprime mortgages issued by criminal bankers and packaged into derivatives given a AAA rating by the greedy compliant rating agencies, the Wall Street cabal knew time was growing short, but that didn’t keep the lying bastards like John Thain (Merrill Lynch), Dick Fuld (Lehman Brothers), Angelo Mozilo (Countrywide), Kerry Killinger (Washington Mutual), and others from pretending their institutions were healthy and profitable – right up until the day they collapsed. Lying is in the DNA of every financial executive, politician, government bureaucrat, and Federal Reserve hack.

The quote from Hemingway seemed pertinent in 2008 and is just as pertinent today.

There are many similarities between what was happening in 2008 and what is happening today. Bear Stearns went belly-up in March 2008 and was taken over by JP Morgan in an arranged marriage by Bernanke and the Fed. The usual suspects assured the country this was a one off situation and the banking system was strong. The Wall Street banks had been reporting huge profits because they were hiding the massive losses on their balance sheets. If they didn’t foreclose, they didn’t have to write-off the mortgages. The toxic debt just kept building.

In the summer of 2008 the banks started to report losses, but assured investors it was only a one time hit. All was well. The week I wrote my article Wall Street bank stocks had soared 20% or more because their reported losses for the 2nd quarter were less than expected. My article cut through all the BS being shoveled by the likes of Larry Kudlow, Jim Cramer, the Wall Street CEOs, and the supposed analyst experts who still had buy ratings on these bloated debt pigs. My assessment was somewhat contrary to the CNBC lies:

“I would estimate that we are only in the early innings of bank write-offs. The write-offs will at least equal the previous peaks reached in the early 1990s. If a large bank such as Washington Mutual or Wachovia were to fail, it would wipe out the FDIC fund. If the FDIC fund is depleted, guess who will pay? Right again, another taxpayer bailout. What’s another $100 or $200 billion among friends.”

Merrill Lynch was reporting billions in losses and issuing new stock to try and survive. They were clearly in a death spiral and I saw the writing on the wall:

“How long will investors be duped into supporting this disaster? You can be sure that the other suspects (Citicorp, Lehman Brothers, Washington Mutual) will be announcing more write-downs and capital dilution in the coming weeks.”

By the end of September Lehman Brothers and Washington Mutual were gone. Merrill Lynch and Wachovia were acquired for pennies, and Citicorp became a zombie bank sustained by the Fed for years. My article was dire and my analysis showed we were in for years of pain and the worst drop in housing prices in history:

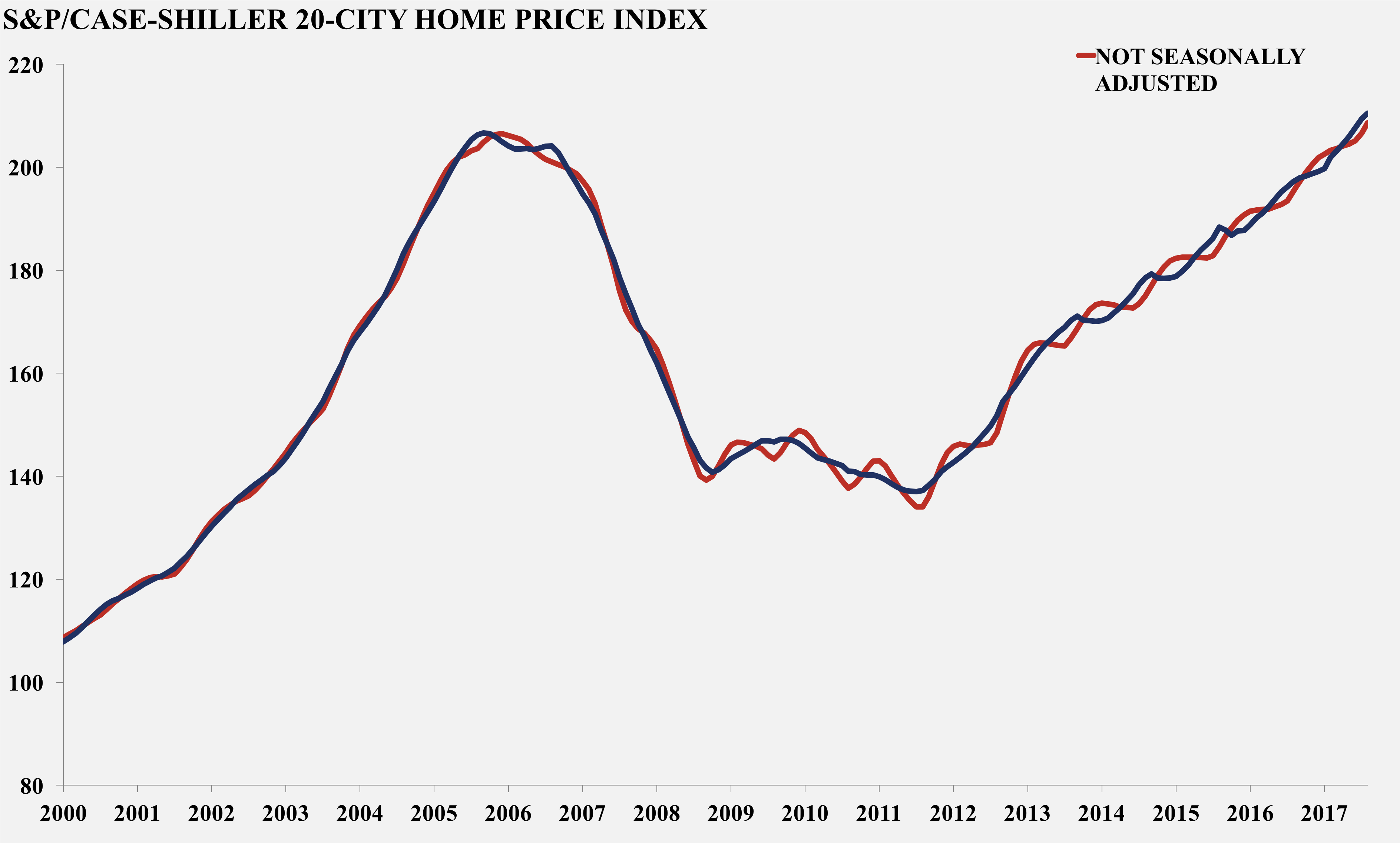

“There are $440 billion of adjustable mortgages resetting this year. That means that the majority of foreclosures will not occur until 2009. This means that the banks will still be writing off billions of mortgage debt in 2009. The reversion to the mean for housing prices and the continued avalanche of foreclosures is not a recipe for a banking recovery. Home prices have another 15% to go on the downside.”

“The consumer is being forced to cut back on eating out and shopping. The marginal players will fall by the wayside. Big box retailers, restaurants, mall developers, and commercial developers are about to find out that their massive expansion was built upon false assumptions, a foundation of sand, and driven by excessive debt.”

It seems I was quite accurate in my assessment, as home prices went down more than 15%, not bottoming until 2012. This global financial collapse brought an end to the big box expansion phase, as many went under, and the survivors concentrated on their existing stores. We entered the worst recession since the 1930s. The most interesting part in going back to my 15 year old article was the psychology of the crowd revealed in the comment section. Despite my use of unequivocal facts, I was branded a doomer, overly pessimistic, and an idiot. Many commenters said the Fed would save the day and it was time to buy the dip. If they had bought the dip on the day of my article, they would have lost 44% over the next 8 months during a relentless bear market.

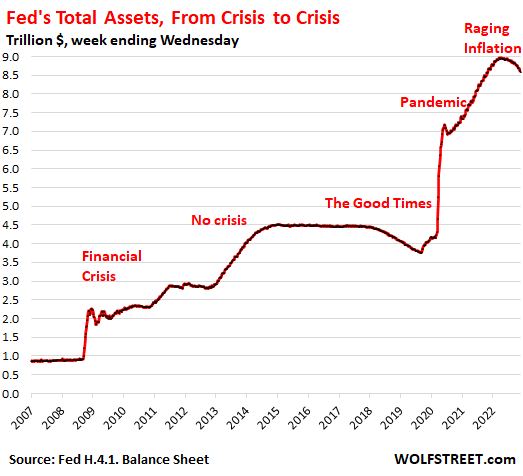

The question now is whether the current situation is better or worse than the situation we faced in 2008. There are some factual items which may help in assessing where we are. In August 2008 the national debt was $9.5 trillion (67% of GDP). Today it is $31.5 trillion (130% of GDP). Total household debt was $12 trillion in 2008 and stands at $17 trillion today. The Fed’s balance sheet was $900 billion in 2008 and now stands at $8.3 trillion. Inflation was at a 17 year high in August 2008 at 5.9% and stands at 6.0% today. GDP was growing at 3.2% in 2008, versus 2.7% today. An impartial observer would have to conclude our economic situation is far worse than 2008.

But all you hear is happy talk and false bravado from Wall Street analysts covering their own insolvent industry. They constantly harp on the fact mortgage lending is much more risk averse and secure. Of course the next liquidity driven crisis is never driven by the same exact factors as the previous liquidity driven crisis. But the key factors are always the same. Loose monetary policies by the Fed lead to excess risk taking by greedy bankers, hedge funds, and corporate executives. Then something blows up and the billionaires get bailed out at the expense of the taxpayers who have been getting devastated financially by the inflation caused by Powell and his printing press.

So far, this latest banking crisis “that no one could see coming”, except any honest financial analyst who understands math and history, is following the same path as 2008. The narrative about banks not taking credit risk and peddling bad mortgages is being blown up as we speak. Instead of the risk being centered on toxic mortgages like 2008, the risk has permeated every crevice of the financial system due to years of 0% rates by the Fed. Virtually everything is overvalued by 30% to 50% because cheap debt was available to everyone for everything. Extremely low interest rates led to extreme risk taking by bankers, corporations, home buyers, auto buyers, and politicians. The unleashing of inflation by Powell’s policies has led to the tide going out and revealing who was swimming naked.

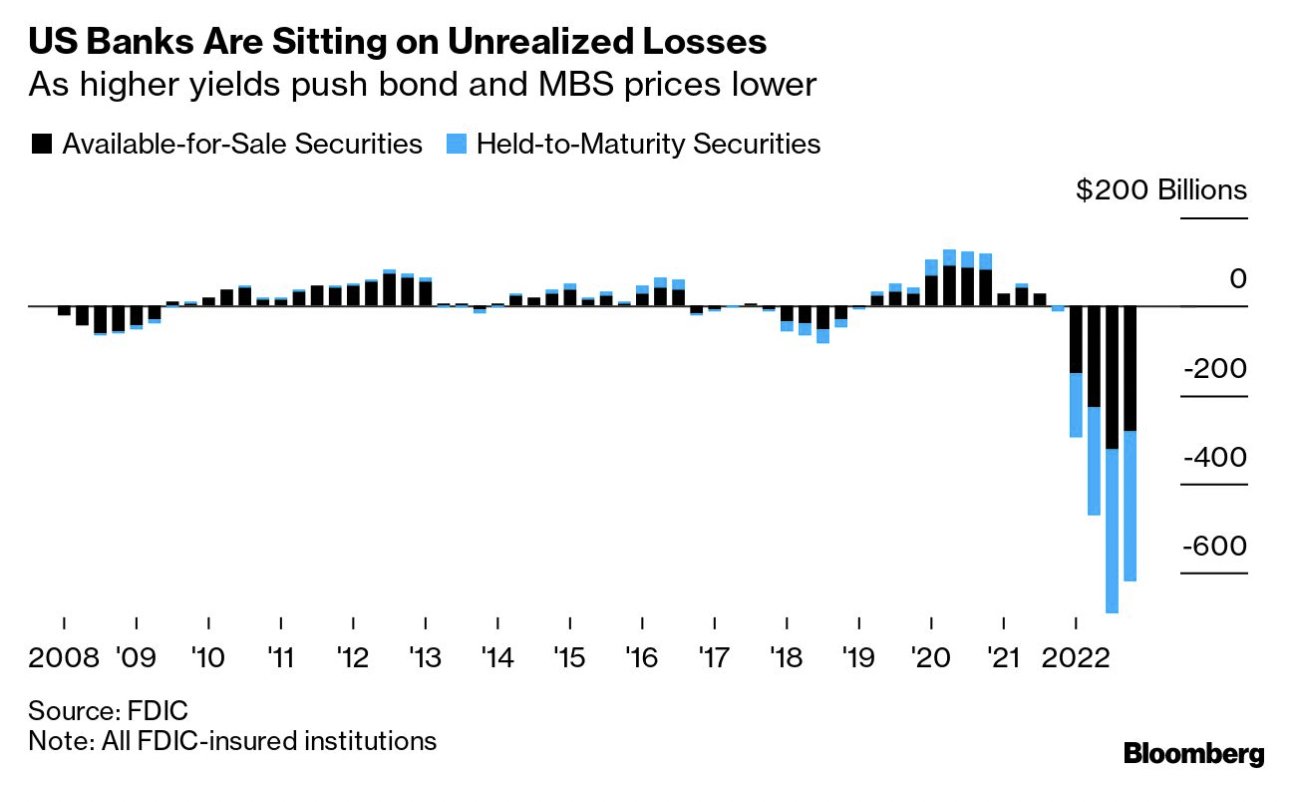

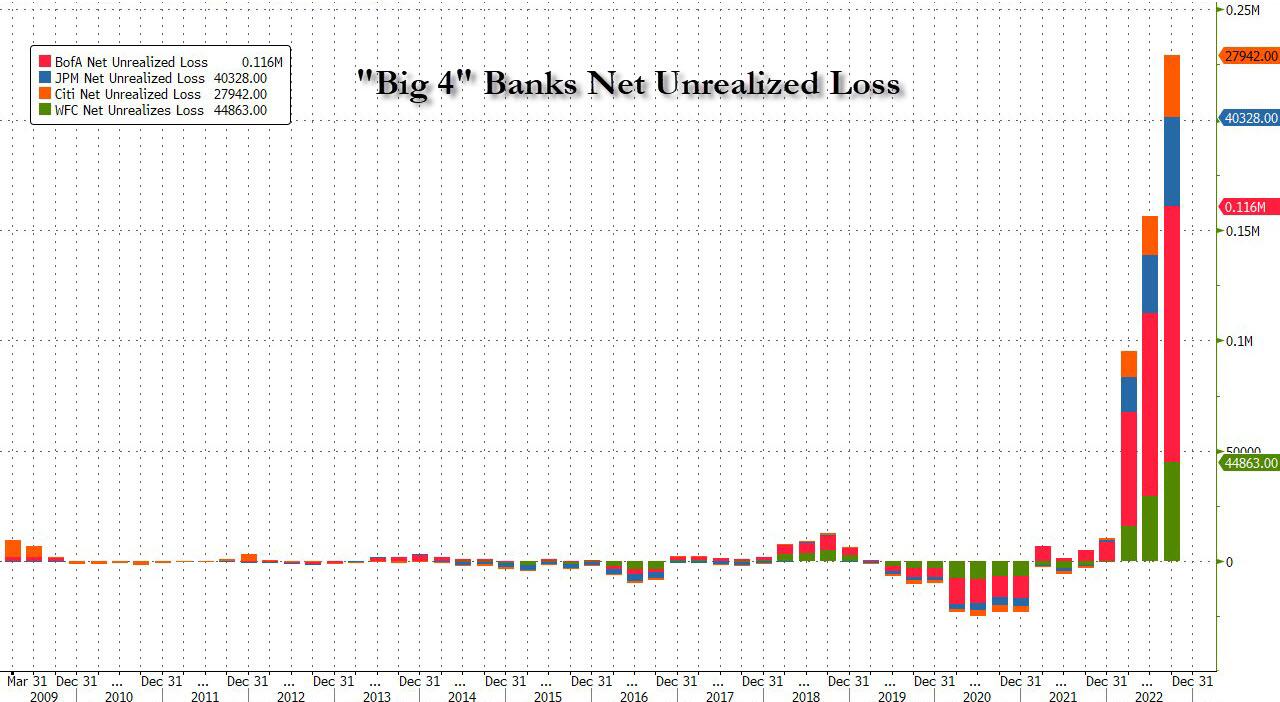

While risk managers at banks across the world have been concentrating on diversity and pushing woke agendas about transgender rights, climate change and practicing ESG investing, they ignored the simple concept that bonds they acquired at 1% lose money when interest rates go to 4%. Just as the banks in 2008 were sitting on billions of unrealized losses from the toxic mortgages on their books, the same banks are now sitting on billions of unrealized losses from the newest toxic asset – U.S. Treasuries. Everyone knows it. It’s just math. They have been counting on Powell to reverse course, but with reported inflation still at 6%, he’s trapped. Silicon Valley Bank and Signature Bank were swimming naked and when depositors realized that fact a bank run ensued. Poof!!! Sudden Crisis.

The narrative being spun is this is a regional banking crisis confined to smaller banks. This narrative is being spun by the big Wall Street banks and their captured media mouthpieces, with the intent that depositors at smaller banks would panic and shift their deposits to the “safe” Wall Street banks. The truth is that the Wall Street banks have massive levels of unrealized losses and desperately need deposits to keep them from facing the same fate as Silicon Valley and Signature. Those unrealized losses aren’t going away and will have to be realized in the near future.

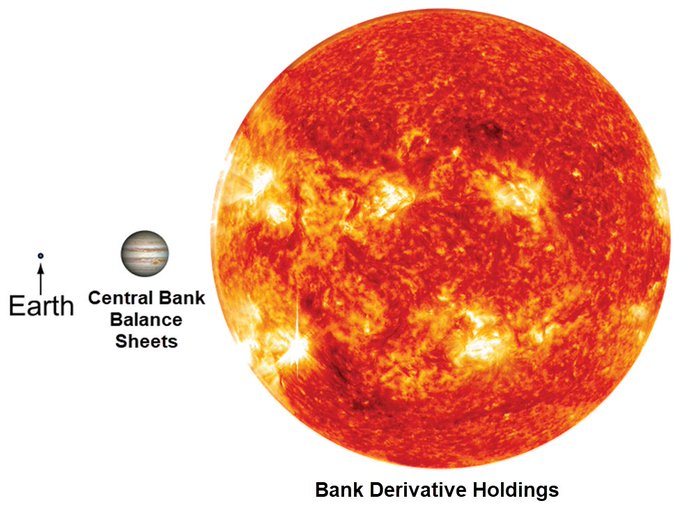

Credit Suisse has been the crazy uncle of the financial industry, kept in the basement for years. Their demise is a foregone conclusion, but that has been covered up and ignored by those in the know. They appear to be the new Lehman Brothers, which will blow up the already insolvent European financial system and spread a contagion of losses across the financial world. Those quadrillions in obscure derivatives are an unknown element in the coming meltdown. But you can be sure they won’t have a positive impact.

Both small and large banks have little to no reserves left to lend. Debt issuance is the Potemkin ingredient in keeping this farce of an economic system running. Without debt to finance overextended consumer lifestyles, funding wars in Ukraine, and the woke agendas of corporations and politicians, the entire facade collapses.

Real wages have been negative for 23 consecutive months. A banking crisis means banks will reduce lending dramatically. Consumers have been forced to live off their credit cards for the last two years, as their savings dried up and their wages bought less. A deep recession is in the cards. Consumers are already pulling back and spending less. With credit drying up and spending going down, employers across the globe will start laying people off. As unemployment rises, people will stop paying their enormous mortgage and auto loans. This will lead to more losses at banks, just like 2008/2009.

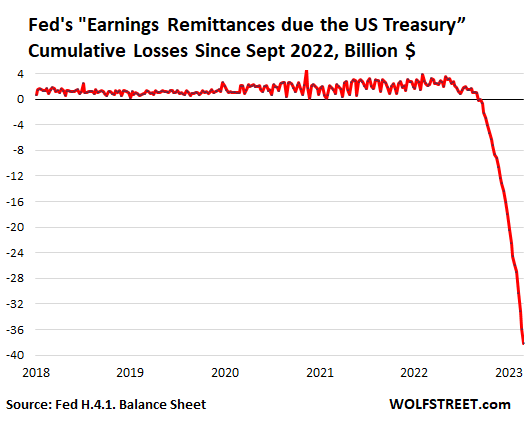

Everyone will look to the Fed to save the day. And they will pretend they have everything under control, but they don’t. Back in 2008 their balance sheet was only $900 billion. Today it is 9 times as large. The relentless QE while interest rates were suppressed has left them with enormous unrealized losses on the mortgage and Treasury bonds they bought. They let the inflation genie out of the bottle and now it is ingrained in the economy. Companies who gave 2% annual raises to their employees for a decade are now forced to give 4% or more due to the Fed created inflation.

If the Fed slashes rates and goes back to money printing through QE, the current 6% inflation rate will skyrocket back to double digits. If Powell does nothing or continues raising rates, the banking system will likely collapse. His choices are deflationary collapse or hyper-inflationary collapse. He’s stuck between the proverbial rock and a hard place. Since he is controlled by Wall Street, he will slash rates, restart QE, backstop the bankers, and screw the average American, as always. My conclusion reached in my 2008 article, just before the financial system imploded seems, for the most part, to apply today.

“The U.S. banking system is essentially insolvent. The Treasury, Federal Reserve, FASB, and Congress are colluding to keep the American public in the dark for as long as possible. They are trying to buy time and prop up these banks so they can convince enough fools to give them more capital. They will continue to write off debt for many quarters to come. We are in danger of duplicating the mistakes of Japan in the 1990s by allowing them to pretend to be sound. We could have a zombie banking system for a decade.”

We never paid the piper and cleaned out the excesses of the previous banking crisis. The financial condition of the nation is far worse than it was in 2008. The financial condition of the average American is far worse than it was in 2008. The financial condition of the Federal Reserve is far worse than it was in 2008. The financial condition of the banking system is far worse than it was in 2008. Our leaders kicked the can down the road in order to give the system the appearance of stability, and we let them do it. We could have taken the pain in 2008 and let the system reset after purging all the bad debt and bad banks, but we chose the wrong path and will now suffer the consequences described by Ludwig von Mises a century ago.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises

My advice 15 years ago at the end of the article was to reduce your deposit exposure at all financial institutions, don’t invest in financial stocks, follow the writings of honest truthful analysts and this final piece of advice, which is as solid now as it was then:

“When you see a bank CEO or a top government official tell you that everything is alright, run for the hills. They are lying. They didn’t see this coming and they have no idea how it will end.”

We are at the beginning of the next global financial crisis, not the end. Fourth Turnings do not fizzle out. They build to a crescendo of chaos and war. This financial crisis will usher in the military conflict that has been beckoning for the last year. Time to buckle up and prepare for the coming storm.

___

https://www.theburningplatform.com/2023/03/15/is-the-u-s-banking-system-safe-15-years-later/