How Monetary Policy Failure Could ‘Graduate Up’ to Globalist Lock-down

Full-Spectrum Domino

“…Fat had come across a perfect description of the

Black Iron Prison…the Empire, as the supra- or t

rans-temporal constant.”

– Philip K. Dick

“Trump is an aberration.”

– George Soros, October 28, 2019

That remains to be seen, Mr. Soros. But it’s true, without Trump things would look altogether bleak for the future of robust democratic governance, the out-of-whack markets being yet another manifestation of human derailment. Our imprimaturs are fast becoming nowhere to be found.

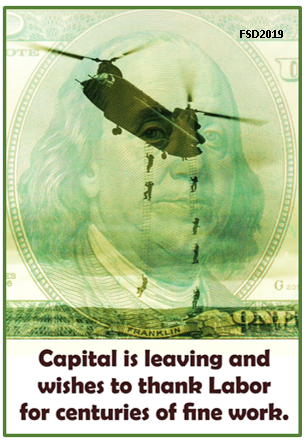

Central Bank hubris has already cost us two venerable pillars of bond market viability: Time Preference and Price Discovery. We’ve lost all notion of time and we don’t know what things are worth. Toss onto this bonfire physical currency (as is planned) and the economic vanishing act will be complete.

All bottoms-up mechanisms meant to reflect collective human judgment, discernment and authentic input are being excised from the markets. The remaining currency? Abject alienation.

Sure, we have residual holdings. But they’ve been emptied of street value and essentially go though hollow gestures in hermetic portfolios deprived of oxygen. No wonder index funds are the rage (and quite possibly the next bubble). As the blind lead the blind, they create an abyss that must first be fallen into in order to be discovered. The so-called collective wisdom of the market is playing Pin the Tail on the Donkey on a massive scale.

The sheer size of global debt obligation ($247T) is simply too large to be left to the machination of mere peeps. Only an authoritarian model can forestall willy-nilly debt repudiation and jubilees-by-plebiscite. Inevitably that’s where populism will converge if it’s allowed. So it won’t be allowed. That in a nutshell is the inherent terror of populism to the banking class. The Orange Man fixation is but the bread-and-circus handle.

We’re in a Mullah-driven, theocratic command structure now, albeit still disguised with flashing CNBC number-boards that chatter about ‘market action’ and authentic price-auction movement with all the nefarious pomp of a Vegas casino.

These bedrock principles will not return under the present Monetarist regime. More likely, they will never return (absent the 11th-hour ministrations of a Trump-like figure). Nor are they meant to, despite the Godot-rhetoric of normalization in some distant future.

The bond market has been severed from its raison d’etre. There is no homecoming. Odysseus is lost at sea.

But is this abundantly telegraphed ‘lostness’ part of a larger voyage, an encapsulating narrative? After all, we’ve been beaten about the ears on the ‘looming debt abyss’ since at least 1992’s Concord Coalition formed by the now-deceased Senators Rudman and Tsongas.

Even Odysseus’ father, Laertes failed to recognize his own returning son. That’s how radically the voyage of life can alter our perceptions. Distortive monetary policy has re-fashioned the coastline, injecting itself into the coves and marshes of economic phenomena itself. Frankly, would we even recognize home if our hulls bumped against its pier?

And so the debt-abyss warnings were great for decades of earnest self-flagellation. Bad, bad present generation! How could you do this to your kids? However the arithmetic of debt left few options. Moreover no one could have plotted this inevitability with more prescience than the Central Banks’ Central Bank, the Bank for International Settlements (BIS).

In his recent book Aftermath, Jim Rickards is very good at describing the end-game of the current monetary regime, although his prognostications are not as dire. Much of his formulation appears here.

We’re probably two years (275 basis-point cuts) away from the end-game which is the death of national (Central Bank) monetary policy and the onset of formal global policy-setting (via a BIS-IMF tandem) with the totalitarian vise of the Green Economy thrown in for good measure.

In short, we could well be completing a centuries-long horrid circle, from Feudalism to Mass General Economy to neo-Feudalism again.

When the Fed injected itself into the economy as a lead actor (in essence Quantitative Easing and Tightening mimic the behavior of an investor, a very dumb one), it set for itself the dual role of re-normalizing/reducing its balance sheet (i.e. its portfolio of securities acquired during QE) while also retaining its primary mandate for smoothing business cycle booms and busts via discount rate adjustments.

Today, these dual roles are at odds with one another. In the attempt to raise rates (in concert with the historical need to cut rates 400-500 basis points going into a recession), Powell ran the risk of creating the recession he was girding to do battle against. He stopped tightening due to the subsequent stock market wobbles last December.

Think of the absurdity of the dilemma. Rates must be raised in order to be cut.

This is what happens when the playwright fatally burdens his play by endeavoring to act within it as well. The author in effect outsmarts the actor –or is it the other way around?

Powell is now in a box and has been cutting (i.e. suspending Quantitative Tightening) in order to forestall a recession which he will be unable to battle anyway since the Fed balance sheet still stands at $4 trillion and market psychology will at some point break when it perceives the Fed to be in an irreversible state of insolvency.

We can say that, due to Bernanke’s horrendous QE experiment and Yellen’s subsequent procrastination, Powell ran out of time to shed the Fed’s liabilities. This puts the Central Banks effectively out of the game for the next inevitable melt-down.

Thus the problem will of necessity ‘graduate up’ to the IMF’s balance sheet where soon-to-be former B-of-E Chairman Mark Carney will await us in his follow-on role as IMF President, complete with the looming new world-reserve-currency and USD-giant-killer, the Synthetic Hegemonic Currency or SHC. The world is about to become the ward of the IMF clinic. Prison Planet? Prison Hospital Planet more like.

The upshot? Globalism wins by default (insurmountable debt peonage). Hence perhaps, George Soros’ recently expressed optimism in the nationalism versus globalism sweepstakes, which is the only REAL battle that’s been happening anyway when you peel away the comic-book antics of Orange Man Bad.

Despite Soros’ (over)-confidence, the battle is far from over. Trump still possesses bullets of his own and the opposition knows it. That’s why, for the globalists, the sooner Trump gets convicted of Biden’s Ukraine crimes, the better. (See Israel Shamir’s mind-blowing interview of Oleg Tsarev; while reading, keep Orwell uppermost in mind: Corruption is Virtue!)

Get your heads out of the newspapers, America. They are the diversionary playgrounds of Managed Consent. Noise. Diversion. Sound and fury. Something really is happening alright. But they’re not about to tell you what. That would be like telling the prospective circus animal his new life will unfold in a cage before the cage-lock is firmly secured.

So, 275 basis points and counting…

The Candyman’s Wagon is the Black Iron Prison – Orwell’s Basel Boot in the face forever. Thin blue line? Last time I checked, the line was a lonely shade of Orange.