The Greatest Bankster-Run

Scam Of The Third Millennium

Submitted by A Former Financial Planner, Investment Broker, Commodities Trader & Business Consultant

Submitted by A Former Financial Planner, Investment Broker, Commodities Trader & Business Consultant

SOTN Exclusive

Let’s start with the alleged developer of Bitcoin—Satoshi Nakamoto.

Really, Satoshi Nakamoto or his clandestine group of bitcoiners created the first decentralized cryptocurrency where nodes in the peer-to-peer bitcoin network verify transactions through cryptography and then record them in a public distributed ledger called a blockchain.

What an incredibly stupid but very dangerous financial joke!

Who the fuck is CIA agent or NSA operative or DARPA asset Satoshi Nakamoto? Oh, that’s who he/they really is/are?!

And yet so many blockchain blockheads fall for this transparent scam of the millennium.

First of all, Bitcoin is anything but a currency since bonafide currencies cannot exhibit such crazy price volatility …. but don’t try to tell a bitcoiner that.

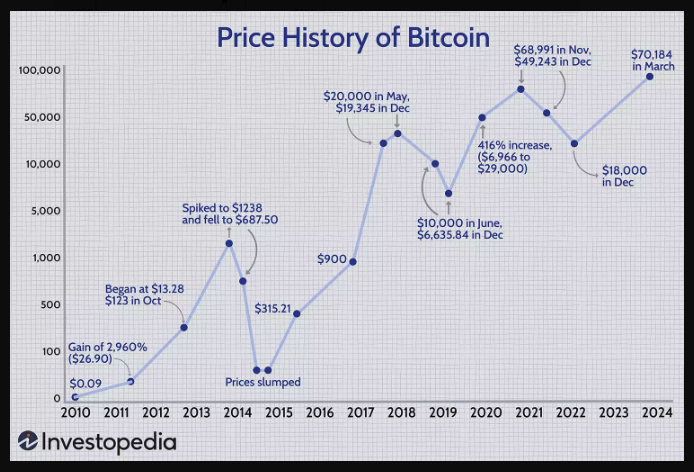

Secondly, Bitcoin is anything but an asset which could be considered a store of wealth. Again, given the insane roller coaster ride it has taken its owners on, to consider it a good store of value is as absurd as it is stupid (see chart below).

Next, Bitcoin is wholly dependent on the existence of the Internet. As though cyberspace is a reliable entity going forward. In other words: no Internet, no Bitcoin transactions. And, your millions are locked up in your Bitcoin coins; that is, if you even have possession of them.

Then there is the stark reality that Bitcoin was created as a highly speculative investment vehicle. As such, it is based on a classic Ponzi-Pyramid scheme. Those who entered the scheme first and to the greatest degree, stand to make the most. The most recent suckers to enter the game get hosed. In point of fact, what we are seeing at this very moment is a ginormous extended Sucker’s Rally (see graph below from Dec. 2021 thru March 2024).

Going form $18,000 in December of 2021 to 72,000+ this March of 2024 is a sucker’s rally just like the first two you see in the chart below that occurred between 2014 and 2021.

We’re told that Bitcoin hit 68,453.60 today after dropping from $72,384.00, which is 5.5% of it’s total value—IN ONE FRIGGIN’ DAY! How’s that for stability?!?!?!

Global Gambling Casino

The Global Gambling Casino has all kinds of games to play these days, but Bitcoin is, by far, the favorite one at the moment. And that’s exactly the way the banksters want it.

Why exactly?

Because it keeps everyone focused on a totally worthless cryptocurrency instead of them buying a very real hard

asset such as gold and silver—THAT’S WHY!

The last thing the banksters want in 2024 and beyond is folks stockpiling those time-tested assets which have proven to be recession-proof, depression-proof and collapse-proof. A good mix of gold bullion and silver coinage can provide the hard currency necessary to get through the inevitable bankruptcy of the US Corporation.

Given all the fake Bitcoin tokens now in circulation, who would ever even go there except a hopeless blockchain blockhead?

However, it’s the role of Bitcoin as an object of pure unadulterated gambling which makes it a true curse. Because who doesn’t know that when you make money fast, you lose it fast … some how, some way. As quickly as fake wealth comes, it goes.

Folks really need to sit back and contemplate this universal principle of money. Because it goes to the very heart of the Bitcoin scam. Making money out of nothing in an obsessive or compulsive manner is NOTHING BUT GREED. And greed is not good—FOR ANYONE.

When anyone makes so much money by doing nothing, it represents a gross imbalance in the cosmic cycle of giving and receiving. First, it’s vital to comprehend that Bitcoin is NOT an investment. It makes nothing, produces nothing, and reflects no effort or genuine industry of any kind except the extraordinarily cost-ineffective and environment-damaging mining of the stuff.

The Bitcoin miners

As a matter of fact, Bitcoin consumes enormous resources in the process of crypto-mining. As follows:

It’s estimated that Bitcoin consumes electricity at an annualized rate of 127 terawatt-hours (TWh). That usage exceeds the entire annual electricity consumption of Norway. In fact, Bitcoin uses 707 kilowatt-hours (kWh) of electricity per transaction, which is 11 times that of Ethereum.

(Source: Why Does Bitcoin Use So Much Energy?)

Not only is there an immense amount of energy usage throughout the entire process of Bitcoin transactions, there is this complicated and protracted period of transaction verification which must take place for each and every Bitcoin transaction.

But it’s Bitcoin’s decentralized structure that drives its huge carbon emissions footprint.

To verify transactions, Bitcoin requires computers to solve ever more complex math problems. This proof of work consensus mechanism is drastically more energy-intensive than many people realize.

“In the case of Bitcoin, this is done by having many different competitors all conduct a race to see how quickly they can package the transactions and solve a small mathematical problem,” says Paul Brody, global blockchain leader at EY.

The miner who completes the mathematical equation the fastest not only certifies the transaction but also gets a small reward for their trouble in the form of a Bitcoin payment.

In Bitcoin’s early days, this process didn’t consume nation-state amounts of electricity. But inherent to the cryptocurrency’s technology is for the math puzzles to become much, much harder as more people compete to solve them—and this dynamic will only accelerate as more people attempt to buy into Bitcoin.

Multiple miners are using electricity in competition for rewards. Even though there may be hundreds of thousands of computers racing to solve the same problem, only one can ultimately receive the Bitcoin honorarium.

“Of course, this is wasteful in the sense that 99.99% of all the machines that did work just throw away the result since they didn’t win the race,” says Brody. While this process produces a fair and secure result, it also creates a ton of carbon emissions. “I very much doubt [whoever founded] Bitcoin anticipated such enormous success in the future and, consequently, the enormous amounts of power we’re talking about,” Brody says.

This process also takes an immense amount of time: Upwards of 10 minutes per Bitcoin transaction. That’s the time it takes for a new block to be mined.

(Source: Why Does Bitcoin Use So Much Energy?)

And bitcoiners love to brag about this blockchain technology. Talk about stupidos! Just re-read the preceding excerpt about the Bitcoin mining process to grasp just how preposterous this whole Bitcoin scam truly is. What an epic swindle mixed with naked fraud on top of a ripoff by the biggest bankster racket in financial history!!!

Oh, and by the way, the enviro impacts alone will end up consuming the planet if a solar flash doesn’t fry the whole place first.

Wait, there’s more … much more.

For instance, there’s absolutely no privacy in the Bitcoin transaction process.

Anyone can see the balance and all transactions of any Bitcoin address. Since users usually have to reveal their identity in order to receive services or goods, Bitcoin addresses cannot remain fully anonymous.

Oh, that’s just great! In this age of no privacy about anything, ever, along comes Bitcoin that has no privacy whatsoever as follows:

Bitcoin transactions are traceable because Bitcoin’s blockchain is completely transparent and every transaction is publicly stored on a distributed ledger. Because of this transparency, transactions are traceable and you can think of the blockchain as a kind of open database full of Bitcoin transactions.

(Source: Are Bitcoin transactions anonymous and traceable?)

Look it, we can go on with this exposé of the Bitcoin super scam but the following piece lays bare all you really need to know before you dump all of your 401K or IRA or Keogh retirement money into it. The link below covers the critical Great Reset aspects of this bankster-conceived conspiratorial plot to steal what little they have not already stolen from US.

CRYPTO CON:

The Trojan Horse

for the GREAT RESET

Finally Exposes Itself

Conclusion

Bitcoiners are perhaps the most deluded and obsessed group of addicts in world financial history. They are similar to the gold bugs of the second half of the 19th century, except that they operate on greed-surging super steroids and are throwing their money at bogus and valueless tokens not hard precious metal. Such a preoccupation with and pursuit of what is nothing but empty air has all the makings of a coming industry-wide catastrophe.

Incidentally, there have been more cryptocurrency scams, where billions upon billions have been lost by cryptobugs since their inception and all of them with virtually no justice, that it’s quite challenging to keep track of them all. The law enforcement agencies know that all crypto is nothing but a CON game of the highest order so they let the thieves have at it. That’s one less billion to buy gold with that would otherwise make it more difficult for the banksters to artificially suppress the gold (and silver) price.

But the biggest aspect of this CRYPTO CON commenced when the banksters decided to issue Bitcoin EFTs. This is where the manipulation of the Bitcoin marketplace will get real interesting, real fast, as Bitcoin shot up to $73,620.oo at 6:30 AM on March 14th. This is where the banksters will have a heyday transforming Bitcoin into a total laughingstock while transferring wealth into their bank accounts at the expense of everybody. Talk about a mega inflation driver! See: Mystery Whale? Really, when this is exactly how they have been manipulating the utterly fake Bitcoin market practically forever.

KEY POINT: Let’s get very real: the very moment that the banksters established the Bitcoin EFT, you knew it was a SUPER CON, and one with a highly hidden agenda as described in the CAVEAT below.

CAVEAT!!! However, at the end of the day, Bitcoin will be used by the banksters to normalize CBDCs worldwide in a way that nothing else could have accomplished that civilization-destroying NWO scheme. This is the real tragedy of Bitcoin; and the countless addicts who embraced the blockchain technology to liberate themselves from the nefarious BEAST System will have only themselves to blame when they wake up one day chained to CBDCs. See: CRYPTO-CON! It’s all about Khazarian banksters buying Bitcoin and Ethereum to manipulate price & normalize the coming CBDCs.

BOTTOM LINE

A Former Financial Planner, Investment Broker, Commodities Trader & Business Consultant

State of the Nation

March 15, 2024