The banksters undoubtedly know that we have reached mathematical certainty and, therefore, they must conduct

their long-planned controlled demolition before an

uncontrollable collapse takes place.

Submitted by a Veteran Financial Analyst and Author from The Market Oracle

SOTN Exclusive

In January of 2009, in the wake of the market crash of 2008, we published the following article: The FOUR FINANCIAL HORSEMEN Herald the Death Knell of Predatory Capitalism.

What follows is a key excerpt from that critical analysis which has since manifested more and more each successive year, but almost completely under the radar. That’s why we are shining light on the pivotal “Quadrillion Dollar Plus Derivative Market” at this very moment.

III. DEMOLITION BY DERIVATIVES; DISINTEGRATION OF THE DERIVATIVES MARKET; “DERIVATIVE DEATH STAR” IMPLOSION

This is where Wall Street high finance meets the blackjack tables of Las Vegas – both literally and figuratively. This marriage of convenience represents the ultimate fusion of everything that was wrong with the MO of today’s (yesterday’s) investment bankster and all the ways that the gambling casino is always rigged by the house (aka the guvment). Just as the house fixes every game in town so that it never loses, the fat cats at Morgan Stanley and Goldman Sachs never walk away from the table without a belly full of fish. Even though many of their bets fell right through the floor, they still, somehow, feel entitled to multi- billion dollar bailouts. Experts at privatizing profits and assets, and socializing losses and debts, they are. Also unparalleled in their ability to turn the entire world into one colossal betting parlor.

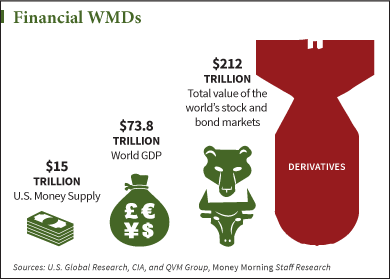

Derivatives are the real hidden time bomb in this whole story. You talk about a wild card – man oh man – it doesn’t get any wilder than the card stamped with “D” for DERIVATIVE. This tangled mess has touched every nook and cranny on every continent, in every nation, in every corporation on planet earth. They don’t even know – We don’t even know – No one knows, if the notional value of the total sum of derivative instruments issued worldwide is closer to 500 trillion dollars or, get this, ONE QUADRILLION dollars. Can you imagine the high intensity hawking that had to happen to get to a place of $1,000,000,000,000,000.00 of highfalutin bets?!?! Oh my gosh! All the gambling casinos in Vegas, Atlantic City, and every reservation in the lower 48 put together couldn’t come close to a mere fraction of that number.

The real challenge concerning this inconceivably heavy lead balloon was how to make it respectable, and legal, and salable, and acceptable, all at the same time. But somehow they did it. Of course they set this little charade up completely outside the normal framework of: (i) governmental regulation, (ii) monitoring by financial analysts, (iii) legal due diligence, and (iv) scrutiny by the financial news media. How many people have even ever heard of a credit default swap, forward rate agreement, or turbo warrant?

We’re talking about the outhouse of the financial industry here, so one must really give them credit for their ability to turn crap into caviar. And then sell it as such, as we mentioned earlier. These crap conversion factories (aka hedge funds) became the ultimate in new age financial alchemy. The hedge fund lab directors somehow managed to transform pure lead into pure gold. Mind you, we’re talking about the proverbial philosopher’s stone, right here, in the midst of the modern financial marketplace. Wonder who the MERLIN was that thought up this scheme which will ultimately ensure the downfall of an entire civilization? We know who the Federal Reserve Chairman was that aided and abetted the perpetrators, as well as helped implement the entire scheme. Probably ought to start there and follow the trail back to those that conceived the whole plot, so that we might at least confiscate their piggy banks. Never has the phrase – pigs at the trough – been more apropos.

The reality was, is, and will forever be that this instrument of high finance – the DERIVATIVE – transformed the entire realm of international finance into a Turkish opium den. Anyone who entered had to be high to get in, and would most assuredly be higher when they left. They all smoked the same crack derivative, could never get enough of it, and, like every addict attempts to do, wanted to turn everyone else onto it. They knew that only through widespread addiction would this habit become institutionally acceptable. And do you know that this ploy worked like a charm! Of course, whole national, and regional economies, will never, ever, be the same, just as gambling has always been notorious for bringing total ruination to the home of an addict.

The saddest part of this story concerns the referral effect which ensured that the real pain from this financial stratagem would be referred to the worker or company or entrepreneur or office worker or small business owner who really does work for a living. And who, in the process, produces a real good or service untainted by hedge upon hedge, bet upon bet, swap upon swap. For it always is the salt of the earth that becomes the unsuspecting fodder, especially in a perpetual war economy that only knows how to sacrifice the “weak” for the benefit of the “strong”.

Here again, demolition by derivatives will prove to be the surest way to bring down virtually every corner, of every floor, of every building, of every financial institution on planet Earth. The derivative casino will go down in history as the most pervasive, unregulated and ‘successful’ gambling establishment of all time. It broke the bank (the FED, the Bank of England, among numerous other central banks), busted up the ‘street’ (Wall Street, cobblestones of the City of London, among other national financial districts) and wreaked havoc within the US & UK governments, among many others throughout Europe, the Pacific Rim, etc. In time it will prove to be the primary reason why whole populations will find themselves broke, busted and disgusted. Truly, the Derivative Death Star will soon glow like a supernova for all future generations to gaze upon.

After this “controlled demolition” runs its course, the only logical and natural consequence will be the complete disintegration of the worldwide derivatives market. Trust will have been so thoroughly diminished in the wake of so many derivative caused disasters that they will become not only the pariah of the financial world, but also rejected by any and all who can say or spell the word – D E R I V A T I V E.

Now, with this undeniable reality check under your belt, every investor can respond appropriately and expeditiously to the now urgent demands of their respective portfolios.

Why expeditiously?

Because there is now mathematical certainty that the “Quadrillion Dollar Derivative Market Implosion” will take place sooner than later.

Why?

Because the banksters have lost control of the narrative which they have always controlled over the centuries.

Not only that, but their highly paid financial engineers can no longer re-engineer the derivative market to prevent a free-fall collapse. It’s now impossible to sustain the patently unsustainable.

In other words, the sheer weight and unwieldy nature of the fatally flawed derivative edifice, which they have constructed in earnest since the 1970s, is such that that market can no longer be supported with just smoke and mirrors, as they have been doing for years.

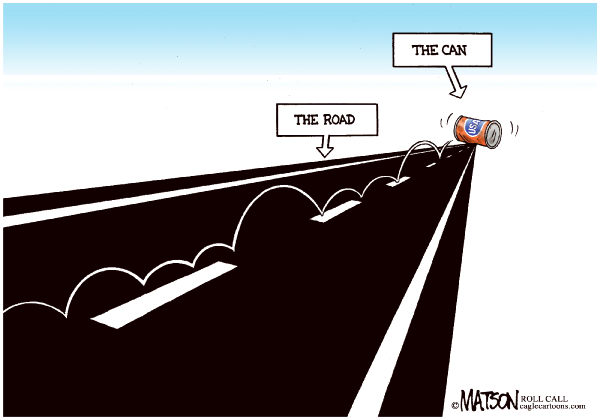

In other words, the banksters can no longer kick the can down the road. And, they are now staring down into the abyss where that road inevitably ends.

A Veteran Financial Analyst and Author from The Market Oracle

State of the Nation

October 7, 2023

How the financial engineers built the Global

Gambling Casino so that when… … …

…the biggest Ponzi scheme in world history

crashes and burns, you will no longer own

your financial assets.

The Depository Trust and Clearing Corporation Goes Rogue—TOTALLY

ROGUE!

SOTN Editor’s Note: What follows is perhaps the single most important exposé on the Internet today for those who want to protect their assets before the Great Reset kicks into high gear. Because, after the point of no return, there will be no recourse for those who are heavily invested in certain financial markets.

These bombshell disclosures specifically concern the DTCC or Depository Trust and Clearing Corporation, which is actually the best kept secret in America. That’s because unconscionable laws have been passed by Congress, as rules and regulation have been set by governing boards, to literally steal the assets of the legitimate owners across various asset classes. And, here’s how the perps can legally get away with it all.

You Will Be Ripped Off In Biggest Financial Scam Ever

(Unless you prepare in advance)

In point of fact, the legal framework and financial structure have been stealthily put into place over decades which permit the DTCC to effectively misappropriate all assets and financial instruments which fall under the jurisdiction of this extremely shady and kleptocratic holding company.

Even very few of America’s financial elites are aware of the fact that this highly predatory and plunderous entity was quite purposefully established in 1973 as The Depository Trust Company (DTC) with a very nefarious agenda. The DTC was then transformed into the DTCC, “an American post-trade financial services company providing clearing and settlement services to the financial markets. It performs the exchange of securities on behalf of buyers and sellers and functions as a central securities depository by providing central custody of securities”. That, there, is the key statement: “providing central custody of securities”. Remember, “possession is 9/10 of the law”.

However, what those elites really don’t know about are the very special powers and unique authorities that the DTCC possesses throughout the entire financial realm, especially concerning the order of debt priority after bankruptcy. Hence, even the billionaires will get ripped off — BIG TIME — should the Great Reset proceed as planned: As the greatest organized theft in recorded history.

KEY POINTS: The following comment, which was posted under this article at TBP, elaborates on a critical data point that SOTN also observed and which cannot be overlooked.

“Note that the petrodollar and the initial DTC were both created at the same time, in 1973. The 1971 renege on gold gave the possibility of completely fiat dollar creation. The petrodollar and the DTC gave mechanisms which made fiat creation not only possible, but almost undetectable by the public. Both have functioned to allow bankers and politicians to create some unknown trillions of dollars without the expected amount of price inflation. The petrodollar exported massive amounts of inflation overseas, and the creation of centralized stock ownership accounting sucked in trillions of dollars from individuals and retirement funds. The real estate market was also artificially pumped to suck in more of the artificial new money. Working synergistically together those programs have kept Americans sleeping while the bankers stole the world.” — The True Nolan

Oh, and by the way, this epic DTCC swindle is only one piece of the long-planned controlled demolition of the Global Economic & Financial System as well explained here:

PULL IT!!!

State of the Nation

October 6, 2023

N.B. Now, read on, to fully understand this “Scam of the Millennium” that’s about to unfold … if the banksters get their way.

“The Great Taking”: How They Can Own It All

Submitted by Ellen Brown

WEB of DEBT Blog

“’You’ll own nothing and be happy’? David Webb has gone through the 50-year history of all the legal constructs that have been put in place to technically enable that to happen.” [Oct 2 interview titled “The Great Taking: Who Really Owns Your Assets?”]

The derivatives bubble has been estimated to exceed one quadrillion dollars (a quadrillion is 1,000 trillion). The entire GDP of the world is estimated at $105 trillion, or 10% of one quadrillion; and the collective wealth of the world is an estimated $360 trillion. Clearly, there is not enough collateral anywhere to satisfy all the derivative claims. The majority of derivatives now involve interest rate swaps, and interest rates have shot up. The bubble looks ready to pop.

Who were the intrepid counterparties signing up to take the other side of these risky derivative bets? Initially, it seems, they were banks –led by four mega-banks, JP Morgan Chase, Citibank, Goldman Sachs and Bank of America. But according to a 2023 book called The Great Taking by veteran hedge fund manager David Rogers Webb, counterparty risk on all of these bets is ultimately assumed by an entity called the Depository Trust & Clearing Corporation (DTCC), through its nominee Cede & Co. (See also Greg Morse, “Who Owns America? Cede & DTCC,” and A. Freed, “Who Really Owns Your Money? Part I, The DTCC”). Cede & Co. is now the owner of record of all of our stocks, bonds, digitized securities, mortgages, and more; and it is seriously under-capitalized, holding capital of only $3.5 billion, clearly not enough to satisfy all the potential derivative claims. Webb thinks this is intentional.

What happens if the DTCC goes bankrupt? Under The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) of 2005, derivatives have “super-priority” in bankruptcy. (The BAPCPA actually protects the banks and derivative claimants rather than consumers; it was the same act that eliminated bankruptcy protection for students.) Derivative claimants don’t even need to go through the bankruptcy court but can simply nab the collateral from the bankrupt estate, leaving nothing for the other secured creditors (including state and local governments) or the banks’ unsecured creditors (including us, the depositors). And in this case the “bankrupt estate” – the holdings of the DTCC/Cede & Co. – includes all of our stocks, bonds, digitized securities, mortgages, and more.

It sounds like conspiracy theory, but it’s all laid out in the Uniform Commercial Code (UCC), tested in precedent, and validated by court rulings. The UCC is a privately-established set of standardized rules for transacting business, which has been ratified by all 50 states and includes key provisions that have been “harmonized” with the laws of other countries in the Western orbit. The UCC makes boring reading and is anything but clear, but Webb has diligently picked through the obscure legalese and demonstrates that the amorphous “they” have it all locked up. They can take everything in one fell swoop, without even going to court. Ideally, we need to get Congress to modify some laws, beginning with the super-priority provisions of the Bankruptcy Law of 2005. Even billionaires, notes Webb, are at risk of losing their holdings; and they have the clout to take action.

About The Great Taking and Its Author

As detailed in the introduction, “David Rogers Webb has deep experience with investigation and analysis within challenging and deceptive environments, including the mergers and acquisitions boom of the 80’s, venture investing, and the public financial markets. He managed hedge funds through the period spanning the extremes of the dot-com bubble and bust, producing a gross return of more than 320% while the S&P 500 and the NASDAQ indices had losses. His clients included some of the largest international institutional investors.”

A lengthy personal preface to the book not only establishes these bona fides but tells an interesting story concerning his family history and the rise and fall of his home city of Cleveland in the Great Depression.

As for what the book is about, Webb summarizes in the introduction:

It is about the taking of collateral (all of it), the end game of the current globally synchronous debt accumulation super cycle. This scheme is being executed by long-planned, intelligent design, the audacity and scope of which is difficult for the mind to encompass. Included are all financial assets and bank deposits, all stocks and bonds; and hence, all underlying property of all public corporations, including all inventories, plant and equipment; land, mineral deposits, inventions and intellectual property. Privately owned personal and real property financed with any amount of debt will likewise be taken, as will the assets of privately owned businesses which have been financed with debt. If even partially successful, this will be the greatest conquest and subjugation in world history.

You might have to read the book to be convinced, but it is not long, is available free on the Net, and is heavily referenced and footnoted. I will try to summarize his main points, but first a look at the derivatives problem and how it got out of hand.

The Derivative Mushroom Cloud

A “financial derivative” is defined as “a security whose value depends on, or is derived from, an underlying asset or assets. The derivative represents a contract between two or more parties and its price fluctuates according to the value of the asset from which it is derived.”

Warren Buffett famously described derivatives as “weapons of financial mass destruction,” but they did not start out that way. Initially they were a form of insurance for farmers to guarantee the price of their forthcoming crops. In a typical futures contract, the miller would pay a fixed price for wheat not yet harvested. The miller assumed the risk that the crops would fail or market prices would fall, while the farmer assumed the risk that prices would rise, limiting his potential profit.

In either case, the farmer actually delivered the product, or so much of it as he produced. The derivatives market exploded when speculators were allowed to bet on the rise or fall of prices, exchange rates, interest rates and other “underlying assets” without actually owning or delivering the “underlying.” Like at a race track, bets could be placed without owning the horse, so there was no limit to the potential number of bets. Speculators could “hedge their bets” by selling short — borrowing and selling stock or other assets they did not actually own. It was a form of counterfeiting that not only diluted the value of the “real” stock but drove down the stock’s price, in many cases driving the company into bankruptcy, so that the short sellers did not have to cover or “deliver” at all (called “naked shorting”). This form of gambling was allowed and encouraged due to a number of regulatory changes, including the Commodity Futures Modernization Act of 2000 (CFMA), repealing key portions of the Glass-Steagall Act separating commercial from investment banking; the Bankruptcy Law of 2005, guaranteeing recovery for derivative speculators; and the lifting of the uptick rule, which had allowed short selling only when a stock was going up.

Enter the DTC, the DTCC and Cede & Co.

In exchange-traded derivatives, a third party, called a clearinghouse, ensures that the bets are paid, a role played initially by the bank. And here’s where the UCC and the DTCC come in. The bank takes title in “street name” and pools it with other “fungible” shares. Under the UCC, the purchaser of the stock does not hold title; he has only a “security entitlement”, making him an unsecured creditor. He has a contractual claim to a portion of a pool of shares held in street name, assuming there are any shares left after the secured creditors have swept in. Webb writes:

In the late 1960’s, something called the Banking and Securities Industry Committee (BASIC) had been formed to find a solution to the “paperwork crisis.” It seemed the burdens of handling physical stock certificates had suddenly become too great, so much so, that the New York Stock exchange had suspended trading some days. “Lawmakers” then urged the government to step into the process. The BASIC report recommended changing from processing physical stock certificates to “book-entry” transfers of ownership via computerized entries in a trust company that would hold the underlying certificates “immobilized.”

Thus was established the Depository Trust Company (DTC), which began operations in 1973, after President Nixon decoupled the dollar from gold internationally. The DTC decoupled stock ownership from paper stock certificates. The purchasers who had put up the money became only “beneficial owners” entitled to interest, dividends and voting rights, leaving title of record in the DTC. The Depository Trust and Clearing Corporation (DTCC) was established in 1999 to combine the functions of the DTC and the National Securities Clearing Corporation (NSCC). The DTCC settles most securities transactions in the U.S. Title of record is with DTC’s nominee Cede & Co. Per Wikipedia:

Cede and Company (also known as Cede and Co. or Cede & Co.), shorthand for “certificate depository”, is a specialist United States financial institution that processes transfers of stock certificates on behalf of Depository Trust Company, the central securities depository used by the United States National Market System, which includes the New York Stock Exchange, and Nasdaq.

Cede technically owns most of the publicly issued stock in the United States. Thus, most investors do not themselves hold direct property rights in stock, but rather have contractual rights that are part of a chain of contractual rights involving Cede. Securities held at Depository Trust Company are registered in its nominee name, Cede & Co., and recorded on its books in the name of the brokerage firm through which they were purchased; on the brokerage firm’s books they are assigned to the accounts of their beneficial owners. [Emphasis added.]

Greg Morse notes that the dictionary definition of “cede” is to “relinquish title.” For more on “beneficial ownership,” see the DTCC website here.

“Harmonizing” the Rules

The next step in the decoupling process was to establish “legal certainty” that the “anointed” creditors could take all, by amending the UCC in all 50 states. This was done quietly over many years, without an act of Congress. The key facts, notes Webb, are these:

- Ownership of securities as property has been replaced with a new legal concept of a “security entitlement”, which is a contractual claim assuring a very weak position if the account provider [bank/clearing agent] becomes insolvent.

- All securities are held in un-segregated pooled form. Securities used as collateral, and those restricted from such use, are held in the same pool.

- All account holders, including those who have prohibited use of their securities as collateral, must, by law, receive only a pro-rata share of residual assets.

- “Re-vindication,” i.e. the taking back of one’s own securities in the event of insolvency, is absolutely prohibited.

- Account providers may legally borrow pooled securities to collateralize proprietary trading and financing.

- “Safe Harbor” assures secured creditors priority claim to pooled securities ahead of account holders.

- The absolute priority claim of secured creditors to pooled client securities has been upheld by the courts.

The next step was to “harmonize” the laws internationally so that there would be no escape, at least in the Western orbit. Webb learned this by personal experience, having moved to Sweden to escape, only to have Swedish law subsequently “harmonized” with the “legal certainty” provisions of the UCC.

“Safe Harbor” in the Bankruptcy Code

The last step was to establish “safe harbor” in the 2005 Bankruptcy Code revisions – meaning “’safe harbor’ for secured creditors against the demands of customers to their own assets.” Webb quotes from law professor Stephen Lubben’s book The Bankruptcy Code Without Safe Harbors:

Following the 2005 amendments to the Code, it is hard to envision a derivative that is not subject to special treatment. The safe harbors cover a wide range of contracts that might be considered derivatives, including securities contracts, commodities contracts, forward contracts, repurchase agreements, and, most importantly, swap agreements. …

The safe harbors as currently enacted were promoted by the derivatives industry as necessary measures . . . The systemic risk argument for the safe harbors is based on the belief that the inability to close out a derivative position because of the automatic stay would cause a daisy chain of failure amongst financial institutions. The problem with this argument is that it fails to consider the risks created by the rush to close out positions and demand collateral from distressed firms. Not only does this contribute to the failure of an already weakened financial firm, by fostering a run on the firm, but it also has consequent effects on the markets generally . . . the Code will have to guard against attempts to grab massive amounts of collateral on the eve of a bankruptcy, in a way that is unrelated to the underlying value of the trades being collateralized.

A number of researchers have found that super-priority in bankruptcy for derivatives actually increases rather than decreases risk. See e.g. a National Bureau of Economic Research paper called “Should Derivatives be Privileged in Bankruptcy?” Among other hazards, super-priority has contributed to the explosion in speculative derivatives, threatening the stability of national and global markets. For more on this issue, see my earlier articles here and here.

What to Do?

Webb does not say much about solutions; his goal seems to be to sound the alarm. What can we do to protect our assets? “Probably nothing,” he quoted a knowledgeable expert in a recent webinar. “We just have to stop them.” But he did point out that even the assets of the wealthy are threatened. If the issue can be brought to the attention of Congress, hopefully they can be motivated to revise the laws. Congressional action could include modifying the Bankruptcy Act of 2005 and the UCC, taxing windfall profits, imposing a financial transaction tax, and enforcing the antitrust laws and Constitutional property rights. As for timing, Webb says just the movement in interest rates, from 0.25% to 5.5%, should have collapsed the market already. He thinks it is being held up artificially, while “they” get the necessary systems in place.

Where to save your personal monies? Big derivative banks are risky, and Webb thinks credit unions and smaller banks will go down with the market if there is a general collapse, as happened in the Great Depression. Gold and silver are good but hard to spend on groceries. Keeping some emergency cash on hand is important, and so is growing your own food if you have space for a garden. Short-term Treasuries bought directly from the government at Treasury Direct might be the safest savings option, assuming the government doesn’t wind up in bankruptcy itself.

Meanwhile, we need to design an alternative financial system that is equitable and sustainable. Promising components might include publicly-owned banks, product-backed community cryptocurrencies, a land value tax, and a financial transaction tax.

A neoliberal, financialized economy of the sort we have today produces little and leaves the workers in debt. Goods and services are produced by the “real” economy; finance is just superstructure. Derivatives do not now produce even the security for which they were originally intended. A healthy, enduring economy must produce real things and exchange them fairly for the wages earned by labor.

____________________

Ellen Brown is an attorney, chair of the Public Banking Institute, and author of thirteen books including Web of Debt, The Public Bank Solution, and Banking on the People: Democratizing Money in the Digital Age. She also co-hosts a radio program on PRN.FM called “It’s Our Money.” Her 400+ blog articles are posted at EllenBrown.com.

___

https://ellenbrown.com/2023/10/03/the-great-taking-how-they-plan-to-own-it-all/?utm