SOFR v. LIBOR: Have We Been Missing Something About the Fed’s Upcoming ‘Policy Error’?

by Tom Luongo

Gold Goats ‘n Guns

The Fed is now firmly committed publicly to a very aggressive rate hike cycle in 2022 and possibly into 2023. It started with the now erstwhile hawks on the FOMC who all got pushed out during last year’s ‘insider trading’ scandal.

It’s continuing today as FOMC Chair Jerome Powell, almost immediately after the ink was dry on March’s anemic 25 basis point raise began ratcheting up the hawk talk in a clear signal to markets that seven quarter-point raises this year won’t be nearly enough to restore the Fed’s credibility with capital markets.

All last year I kept telling you that there was a major internal battle happening for control over the Fed in order to stop the ‘policy error’ of raising rates into a supply-constrained cost-push inflation cycle.

I won’t rehash all the twists and turns of this story today because the fact that we are here with Powell as Chair pro-tem, still awaiting a proper confirmation hearing is the one thing you need to know that proves that correct. The Democrats continue pushing outright communists onto the FOMC board like Sarah Bloom-Raskin to replace the scalps taken last fall to forestall Powell’s actual confirmation.

Powell absolutely wants to make Monetary Policy American Again, after fifty years of Eurodollar markets setting monetary policy for them. As Jeff Snider so painstakingly has proven to us, the Eurodollar system is more powerful than the Fed in creating dollars and pricing the risk of those new dollars.

With a sympatico Congress that never met a spending bill it couldn’t compromise it’s way to betraying the American people with, for decades we’ve seen nothing but rearguard actions by the Fed when it tried to normalize interest rates.

The failure to pass Build Back Better was the watershed moment for us here in the US. Without it, a Powell-led Fed was free to eventually end QE and begin raising rates. It needed time in 2021 for the inflation narrative to outrun the COVID-19 narrative. Once the latter ended the political support for BBB vanished and Powell was free to begin the tightening cycle.

Because we’ve been so conditioned to the Fed caving in the past we’ve come to expect it as de rigeur they will cave again. This is why there was so much disbelief leading up to the March meeting that the Fed would actually raise rates.

The typical Austro-libertarian analysis is, unfortunately, as brain dead as it is dead right, in theory. For a taste of it I refer you to the podcast I did recently with Peter Boockvar. But you’ll hear similar analysis from Peter Schiff and his stable of writers.

I don’t disagree that the Fed is facing unpalatable choices. The Fed is trapped along certain vectors. It can’t raise rates without causing a recession or destroying the yield curve.

So, they argue, the Fed will have to reverse any rate hikes because if they don’t it will blow up credit markets and then be blamed for killing the golden goose. Politically, it’s always a non-starter. So, the Fed will raise rates and then give them all back.

At what point will that happen? 1% on the Fed Funds? 1.5%? 3%?

But there are a number of underlying assumptions in that conclusion that may no longer be accurate.

And it is these assumptions that have led me to consider what if the Fed isn’t operating based on the same metrics of the previous cycles?

If you reject that outright, you get Mr. Boockvar’s or Mr. Schiff’s take. It’s the safe conclusion. It’s based on past behavior.

But is it based on the current market conditions?

I don’t think so. In fact, I’ve come to the conclusion that nothing about the current state of affairs politically, economically or militarily are anywhere close to similar to where we were in early 2019 when the Fed followed the ECB in cutting rates because their markets became unstable.

I’ve written extensively that I felt the Fed began tightening last June with their raising the payout rate on reverse repos to a measly 0.05%. This had the momentous effect of crashing the euro 3% in a day while Biden pushed confrontation with Russia over Ukraine out for another eight months in Geneva when he met with Putin.

It ended any thought of a bull market in the euro versus the US dollar.

So, while I’ve been arguing for a while that the Fed has been in tightening mode for months, the thing that eluded me was how were they going to pull that off without a repeat of past performances?

The underlying assumption for this is that the Fed, as an advocate for U.S. commercial banking interests, is engineering a split with the Eurodollar system which has now reached the end of its ‘use-by’ date, given the dire fiscal circumstances the U.S. finds itself in.

Moreover, I’m further postulating, and I think with good reason, that the Biden Administration and most of the leaders in Congress do not work for American interests, but the opposite. It is the only realistic explanation for their behavior, especially since the beginning of Russia’s war with Ukraine.

So if Biden et.al. works for Davos and Davos wants an end to U.S. commercial banking dominance, then it makes sense they would need control over the Fed to pull off their move to central bank digital currencies (CBDCs) and create the apotheosis of the Great Reset.

Under those conditions the Fed would absolutely act ‘out of character,’ leaning into the ‘policy mistake’ of raising rates into a stagflationary environment with US debt to GDP at 109%.

Again, the problem arises, the minute the Fed goes hawkish they will have to reverse themselves quickly lest they torch the global credit markets.

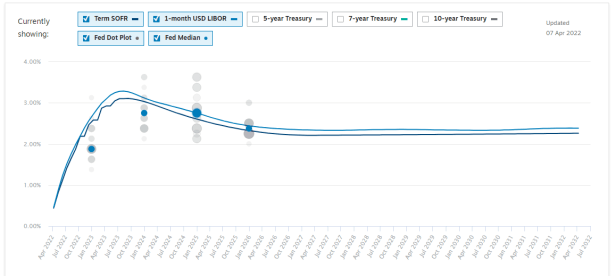

And this is where I think SOFR plays a big role in destroying the thesis that the Fed is trapped in the same way that it has been in times past.

What is SOFR? The Secured Overnight Funding Rate. It is the U.S. domestic replacement for LIBOR. SOFR is market driven arrived at through actual transactions in the U.S. money markets with the daily quote arrived at by real data from real US banks.

LIBOR, on the other hand, is a rate set by 17 foreign banks and 1 U.S. bank (JP Morgan Chase’s London Division). It’s still not market driven but arrived at by consensus. Regardless of that it represents the activity within London’s and Europe’s banking system, not the U.S.’s.

And therein lies the rub.

For all intents and purposes for decades LIBOR was the mechanism by which City of London and Europe controlled the flow of dollars into and out of their banking system. No wonder the Fed had no real control.

Broadly speaking, when the Fed raises rates and it causes a drain on the eurodollar system, it puts upward pressure on LIBOR. If Europe’s banks are more exposed to a rise in the cost of dollars then LIBOR should blow out faster than the Fed raises rates.

In past cycles, before SOFR, all US debt was indexed to LIBOR. So, it didn’t matter if the Fed raised rates domestically, our mortgages, lease rates, and credit lines blew out with LIBOR even if there was no underlying stress in these domestic markets.

Now, in 2022, with all US debt indexed to SOFR and almost all legacy debt reindexed to it over the past four years, when the Fed raises rates U.S. debt rates rise with it, rather than with LIBOR. In short, SOFR breaks the link where Europe or London’s problems cross the pond and become our problems.

It leaves them free to pursue insane monetary policy like, say, negative nominal rates, for a full decade but can no longer force the U.S., in effect, to fund it.

As the Fed raises rates this summer the possibility exists that SOFR insulates the US from the havoc that the draining of eurodollar markets will have on LIBOR-indexed debt.

Remember also that the SOFR crisis of 2019 was due to the U.S. markets running out of cash caused by U.S. banks refusing to take European debt as collateral for repos throughout the year. It forced the Fed to open up the repo window to provide that cash and alleviate the problem in the short term.

This is a clear ‘shot across the bow’ from US commercial banks saying they were done financing Europe’s debt orgy. The battle lines, I think, were drawn in 2019 and the next phase of the battle is on the table today now that Powell and company have a fully realized SOFR market operating in all areas of U.S. debt markets.

This is what has changed. This is one more weapon in the Fed’s arsenal to wrest control over U.S. policy, both fiscal and monetary, that it can use to assert its independence and put the U.S. back on something close to a sustainable path.

Europe, on the other hand, can no longer count on their controlling LIBOR to get the dollars they need from either a willing Congress and a trapped or captured Fed.

Moreover, if you really begin to think through this, again in broad terms, it puts the new pricing system for commodities thanks to the Russians, i.e. rubles = gold = oil = commodities, on the other side of Europe saying in no uncertain terms #GotGoldOrRubles?

And they can’t print the same number of eurodollars they used to. So, now what?

This is where we are today. I laid out this whole thing in a recent interview with Chris Marcus at Arcadia Economics.

I’m not saying in any way that what I’ve outlined here is the only new fulcrum on which the future of financial markets rest. That would be ridiculously arrogant.

But I am saying, as always, that if you don’t constantly challenge your assumptions about how things work and what the motivations are of the people who operate these systems then you are likely to make a foundational mistake about where we are headed.

Because how else do you explain the Fed so rapidly reversing course on ‘inflation is transitory’ to ‘inflation requires extreme measures’ to the point where uber-dove and MMT fan girl, Lael Brainard is now talking the hawkish talk?

What if the goal of this FOMC is bigger than just the normal steering us through a difficult time? What if this time it is the Mises Crack-Up Boom and the old alliances are gone and it’s now an all-out Hobbesian war of “all against all” not only geopolitically but financially as well?

What if the Fed’s upcoming ‘policy error’ is nothing of the sort but a sincere attack on its biggest enemies?

Under those circumstances anything is possible. And if you aren’t willing to reframe the current conflicts along the proper lines, I would remind you of what Ayn Rand would say, “Check your premises.”

___

https://tomluongo.me/2022/04/07/sofr-v-libor-missing-something-fed-policy-error/