Bitcoin Tops $58k, More Valuable Than A Kilo Of Gold

ZeroHedge.com

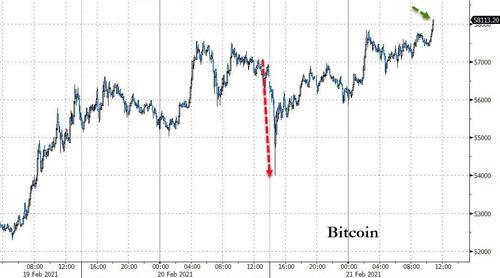

After “collapsing” yesterday from over $57,000 to $54,000, Bitcoin has been bid back up to new record highs, just surpassing $58,000 for the first time ever…

Source: Bloomberg

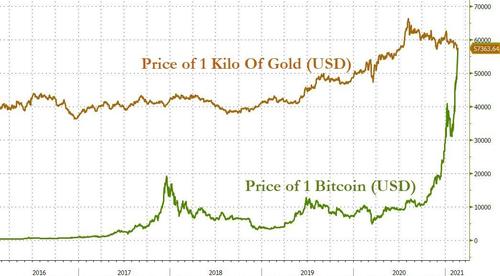

Which has interestingly pushed the price of 1 bitcoin above the price for 1 kilo of gold for the first time ever…

Source: Bloomberg

This latest move comes after a Twitter debate with bullion dealer Peter Schiff on the relative merits of Bitcoin compared with gold as a store of value, Tesla CEO Elon Musk said, “you might as well have crypto.”

As Decrypt reports, Schiff Gold chairman and precious metals dealer Peter Schiff jumped on a tweet published yesterday by Elon Musk, in which the Tesla CEO echoed verbatim a tweet he wrote before Christmas, saying: “Bitcoin is almost as bs as fiat money.”

Musk’s tweets to his 47.4 million followers influence crypto prices dramatically, and he often engages with others in dialogue over crypto. In fact, a tweet exchange with MicroStrategy CEO Michael Saylor may have inclined the Tesla man towards Bitcoin in the first place.

Schiff managed to lure Musk into a conversation about comparing gold with Bitcoin as a store of value. Schiff replied to Musk that, “I agree, I just think Bitcoin, which is digital fiat, is even more BS than the paper fiat issued by central banks. #Gold is not BS. It’s real money and better than both!”

The Tesla CEO replied to Schiff by saying “An email saying you have gold is not the same as gold. You might as well have crypto”:

Musk reasoned that money in both instances is “just data that allows us to avoid the inconvenience of barter.” He went on to say: “That data, like all data, is subject to latency & error. The system will evolve to that which minimizes both.”

Musk is implying that technologies such as Bitcoin, beefed up by cryptographic security, could provide more error-free ways of recording value than the systems we currently have in place—perhaps even better than an email from Schiff Gold saying that you have gold.

Schiff is not alone in his skepticism as CoinTelegraph notes, many ‘experts’ have expressed numerous arguments against Bitcoin over the past decade or so. The digital asset has endured multiple volatile cycles, rising dramatically in price followed by subsequent retracement periods — sometimes seeing up to 80% or more of price decline over time before resuming its uptrend.

Gold advocate and financial commentator Peter Schiff has stated his skeptical position on Bitcoin on numerous occasions. “Now that #Bitcoin has hit $50,000 I must admit that a move up to $100,000 can’t be ruled out,” Schiff said in a February 2021 Tweet, adding:

“However a move down to zero can’t be ruled out either. While a temporary move up to $100K is possible, a permanent move down to zero is inevitable. If you don’t want to gamble buy #gold.”

Others have also called Bitcoin a bubble, such as Russian politician Anatoly Aksakov in early 2021. Additionally, Kenneth Rogoff, a professor at Harvard University, proved hesitant on BTC in January 2021. “I’ve been a Bitcoin skeptic, and certainly, the price has gone up, but there’s sort of an ultimate question of what’s the use,” Rogoff told Bloomberg. “Is it just valuable because people think it’s valuable? That is a bubble that would blow up,” he added.

Still, even though Bitcoin is not technically “backed” by anything, it is also not tied to the debt or struggle of any specific country. It is run by the people, is borderless, and allows users to hold and control their own funds, as well as transact globally quickly. The asset has endured its fair share of adversities since its inception, growing in adoption with every cycle.

___

https://www.zerohedge.com/crypto/bitcoin-tops-58k-more-valuable-kilo-gold