Coinbase Valued At $100 Billion, More Than CME, ICE, CBOE And Nasdaq

ZeroHedge.com

Bitcoin’s explosive price surge in the past year which has pushed its market cap well over $1 trillion for the first time, has not only benefited the cryptocurrency and its peers, but has sent shockwaves across downstream sectors which cater to providing access to the soaring demand for crypto exposure around the world.

And few “conventional” companies have benefited more from bitcoin’s ascent than Coinbase, which according to The Block Crypto was valued at a stunning $100 billion in its latest private round sale ahead of the crypto exchange’s long-awaited direct listing.

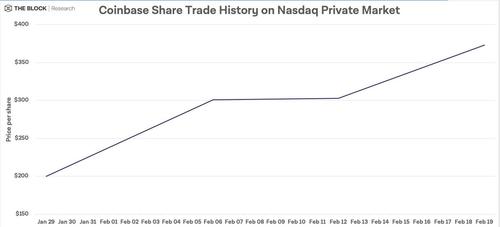

As The Block reports, the average clearing price for shares on Nasdaq Private Market continues to tick higher since the first secondary sale four weeks ago. As an aside, Axios notes that Coinbase launched a secondary share sale via Nasdaq Private Markets (f.k.a. Second Market) last month, offering up to 1.8 million shares in weekly batches. The goal was to help Coinbase determine a reference price for its public offering, which will be done via direct listing instead of IPO.

The most recent cleared price was $373 a share, which would imply a valuation of about $100 billion. That’s an increase from the first average cleared price of $200 in January, when an initial batch of 75,000 shares was sold on Jan. 29.

Coinbase launched a secondary share sale via Nasdaq Private Markets (f.k.a. Second Market) last month, offering up to 1.8 million shares in weekly batches. According to Axios, the goal was to help Coinbase determine a reference price for its public offering, which will be done via direct listing instead of IPO. That said, it’s “unclear if the secondary share sale is still useful to Coinbase for the purpose of determining a reference point for direct listing, given the upward surge.”

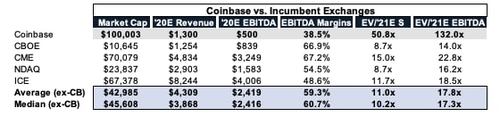

In any case, the latest reference prices mean that the value of Coinbase has nearly doubled in less than two month; it also means that the crypto exchange is now more valuable than all incumbent exchanges such as NYSE parent ICE, the CBOE, the CME and the Nasdaq.

When compared to its traditional equity peers, the Coinbase valuation is absolutely staggering, as its $100BN valuation represents a 132X Fwd EBITDA multiple compared to a 17.8x average for its peer group.

According to Axios, the $100BN price tag means that Coinbase could go public at a higher initial valuation than any other U.S. tech company since Facebook.

If Coinbase is worth a staggering $100 billion, we wonder what that means for crypto-focused fintech names such as Silvergate Capital, which is the leading bank for crypto startups (its clients include the Winklevoss twins’ Gemini exchange, Paxos, bitFlyer and Kraken) and which at last check had a market cap of just $4 billion.

___

https://www.zerohedge.com/crypto/coinbase-valued-100-billion-more-cme-ice-cboe-and-nasdaq